- Home

- Specials

- Shop

- Shop

- Best Sellers

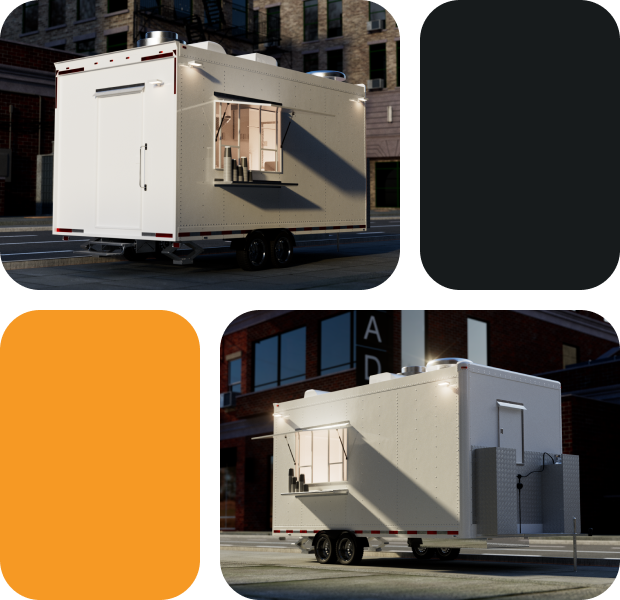

The Best Seller food trailer for sale industry has been booming in recent years. Entrepreneurs everywhere are taking advantage of this lucrative business opportunity, and for a good reason! Food trailers provide flexibility, affordability, and the chance to share your culinary passion with the world. One of the most popular and reliable food trailer manufacturers is Golden State Trailer. In this article, we’ll cover the best sellers food trailers for sale by Golden State Trailer and discuss their unique features, customization options, and benefits.

- Specials

- Custom Food Trailers

About Golden State Trailers

Golden State Trailers is a leading manufacturer of custom food trailers. We pride ourselves on providing our customers with top-quality products that meet their specific needs. We have a team of experienced professionals who work tirelessly to ensure that each trailer we build is of the highest quality.

Our Products

We offer a wide range of custom food trailers for sale. Whether you’re looking for a small trailer to sell hot dogs or a large trailer to serve a full menu, we have options that will meet your needs. All of our trailers are built with high-quality materials and are designed to be durable and long-lasting.Some of our most popular trailers include:

Concession Trailers – Perfect for selling snacks, beverages, and other small items.

BBQ Trailers – Ideal for serving up delicious barbecue dishes.

Pizza Trailers – A great option for pizza lovers.

Ice Cream Trailers – Perfect for selling ice cream and other frozen treats.

Food Trucks – Ideal for serving a full menu of food.In addition to these options, we also offer custom trailers designed to meet your specific needs. Whether you need a trailer with a specific layout, additional equipment, or unique branding, we can help.

Why Choose Golden State Trailers?

When you choose Golden State Trailers, you’re choosing a company that is committed to your success. We work with you every step of the way to ensure that your trailer meets your specific needs. From the initial design phase to the final delivery, we’re here to help.Our trailers are built to last and are designed with your business in mind. We use only the highest quality materials and equipment, ensuring that your trailer will be durable and reliable.

Contact Us Today

If you’re ready to explore our catalog of custom food trailers for sale, contact Golden State Trailers today. Our team of experts is ready to help you find the perfect trailer for your business. With our help, you’ll be on your way to success in no time. - Concession Food Trailers & Trucks

Concession food trailers are a great way to start your own food business. These trailers are mobile, affordable, and versatile. You can take your food business anywhere, and they offer a low entry point for entrepreneurs. In this article, we will discuss concession food trailers for sale at Golden State Trailer, one of the leading trailer manufacturers in the USA.

Introduction

Concession food trailers are a popular choice for those who want to start their own food business. They are ideal for food trucks, food stands, and catering services. With a concession trailer, you can take your business to different locations, attend events and fairs, and serve your food to a wider audience. Golden State Trailer offers a variety of concession food trailers that are affordable, customizable, and built to last.

Advantages of Concession Food Trailers

Before we dive into the specifics of Golden State Trailer’s concession food trailers, let’s explore the advantages of these trailers:

Mobility

One of the biggest advantages of concession food trailers is their mobility. You can take your business to different locations and serve a wider audience. You can attend events, fairs, and festivals, and cater to different crowds.

Affordability

Concession food trailers offer a low entry point for entrepreneurs who want to start their own food business. They are cheaper than brick-and-mortar restaurants, and you can customize them to suit your needs and budget.

Customizability

Concession food trailers are highly customizable. You can design your trailer to fit your business needs and brand. You can choose the size, layout, equipment, and decorations that fit your style and cuisine.

Versatility

Concession food trailers can be used for a variety of food businesses, such as food trucks, food stands, and catering services. They are versatile and can be adapted to different cuisines and cooking styles.

Golden State Trailer’s Concession Food Trailers

Golden State Trailer is a leading manufacturer of concession food trailers in the USA. They offer a variety of trailers that are customizable, affordable, and built to last. Here are some of the trailers they offer:

Food Truck Trailers

Golden State Trailer offers a range of food truck trailers that are designed for mobility and versatility. They are ideal for food truck businesses, and you can customize them to fit your needs and budget.

Concession Trailers

Concession trailers are designed for food stands and catering services. They are affordable and customizable, and you can choose the size, layout, and equipment that fit your business needs.

BBQ Trailers

BBQ trailers are designed for BBQ businesses and outdoor cooking. They are customizable, and you can choose the size, layout, and equipment that fit your cooking style.

Catering Trailers

Catering trailers are designed for catering services and events. They are customizable, and you can choose the size, layout, and equipment that fit your catering needs.

Mobile Kitchens

Mobile kitchens are designed for professional chefs and cooking services. They are customizable, and you can choose the size, layout, and equipment that fit your cooking style.

Why Choose Golden State Trailer?

Golden State Trailer offers a range of concession food trailers that are affordable, customizable, and built to last. Here are some reasons to choose them:

Quality

Golden State Trailer uses high-quality materials and equipment to build their trailers. They are designed to withstand the wear and tear of mobile cooking and last for years.

Customizability

Golden State Trailer offers a range of customization options, so you can design your trailer to fit your business needs and brand.

Customer Service

Golden State Trailer offers excellent customer service and support. They can help you with the design, construction, and maintenance of your trailer.One of the main reasons that Concession Food Trailers are so profitable is the high demand for food at events. People attend events to have a good time and often look for a variety of food options to enjoy while they are there. With a Concession Food Trailer, you can provide a wide range of food options, such as burgers, hot dogs, popcorn, cotton candy, and more, meeting the diverse needs of your customers.

Another benefit of opening a Concession Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Concession Food Trailer, you can take your business to different events and locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose which events to attend, whether it be a local fair or a major sporting event.

Another benefit of owning a Concession Food Trailer is the ability to experiment with different food options and to adapt to the event or location. Entrepreneurs can get creative and offer a variety of food options that suit the event, such as a variety of popcorn flavors at a movie night, or offer healthier options such as fresh fruits or salads.

Finally, Food trailers are a great way to create a unique branding and marketing strategy, as it is a moving billboard for your business. And with the help of social media, you can easily reach a large audience, and attract customers to your food trailer.

- Best Sellers

- Food Trailers Sizes

- 16ft Food Trailers

Are you looking for a 16 foot food trailer for sale? Look no further! We have the perfect trailer for you! Our 16ft food trailers are perfect for catering events, start up businesses, and more. With a wide selection of options to choose from, you can find the perfect trailer for your needs. Shop now and get the perfect trailer for your needs.

- 18ft Food Trailer

Discover the Ultimate 18ft Food Trailer: Are you ready to take your food business to the next level? Our 18ft food trailer is here to make your dreams come true! Designed for maximum efficiency and functionality, this spacious trailer is perfect for food entrepreneurs looking to serve delicious treats on the go.

- 20ft Food Trailers

Are you looking for the perfect 20 foot food trailer for your business? Look no further! Our 20 foot food trailers are lightweight and easy to transport, and we have a wide selection of models to choose from. Whether you’re a budding entrepreneur looking to start a food truck business or a seasoned professional looking to expand your fleet, you’re sure to find the perfect 20 foot food trailer for sale here. Shop now and find the perfect 20 foot food trailer for your needs!

- 22ft Food Trailer

Are you in the market for a 22ft food trailer? Look no further! Our 22ft food trailers are the perfect solution for food entrepreneurs and mobile catering businesses.

- 24ft Food Trailer

- 26ft Food Trailer

- 28ft Food Trailer

- 30ft Food Trailer

- 16ft Food Trailers

- Food Trailers Types

- Mobile Kitchen Trailer

Find Your Perfect Mobile Kitchen Trailer for Sale Today!

Are you on the hunt for the perfect mobile kitchen food trailer? Look no further than Golden State Trailer! Our selection of high-quality trailers includes everything from small mobile kitchen trailers to commercial kitchen trailers and everything in between.Whether you need a mobile catering kitchen trailer for your business or a mobile field kitchen trailer for your next outdoor event, we have you covered. Our trailers are designed to meet the needs of any food service operation, with features like ample storage space, commercial-grade appliances, and customizable layouts.

At Golden State Trailer, we understand that every business is unique, which is why we offer a range of mobile kitchen trailer options to suit your specific needs. Our mobile kitchen concession trailers are perfect for food vendors, while our mobile kitchen semi trailers are ideal for larger operations that require more space.

When you choose Golden State Trailer, you can rest assured that you’re getting the best quality mobile kitchen trailer for your money. Our prices are competitive, and we offer a range of financing options to make your purchase as affordable as possible.

So why wait? Browse our selection of mobile kitchen trailers for sale today and find the perfect trailer for your business. With Golden State Trailer, you’ll be able to take your food service operation to the next level and reach new heights of success.

Explore Your Culinary Dreams with our Mobile Kitchen Trailers for Sale

Are you a culinary enthusiast looking to turn your passion into a profitable business? Look no further than Golden State Trailer’s mobile kitchen trailers for sale!Our selection includes a variety of options to suit your needs, from the compact and efficient small mobile kitchen food trailer to the spacious and versatile mobile commercial kitchen trailer. We also offer mobile kitchen concession trailers and even mobile field kitchen trailers for those who need to take their cooking skills on the road.

With a mobile kitchen trailer from Golden State Trailer, you can explore your culinary dreams and bring your delicious creations directly to your customers. Whether you’re starting a food truck business or catering events, our trailers provide the flexibility and convenience you need to succeed.

Our mobile kitchen trailers are built to last, with durable materials and quality craftsmanship. And with our competitive mobile kitchen trailer prices, you can invest in your business without breaking the bank.

Don’t wait to start your culinary adventure – browse our selection of mobile kitchen trailers for sale today! From the trailer mobile kitchen to the mobile kitchen semi trailer, we have everything you need to get started. Contact us to learn more about our mobile kitchen trailers for sale and take the first step towards your culinary dreams with Golden State Trailer.

Transform Your Culinary Dreams into a Mobile Reality with Our Kitchen Trailers!

Are you a food lover with a dream to take your culinary creations on the road? Look no further than Golden State Trailer! Our mobile kitchen trailers are the perfect solution for turning your culinary dreams into a mobile reality.Our selection of mobile kitchen trailers includes everything from small mobile kitchen trailers to commercial-grade trailers for larger operations. Whether you’re looking for a mobile field kitchen trailer or a mobile kitchen concession trailer, we have the perfect fit for your needs.

At Golden State Trailer, we pride ourselves on providing high-quality mobile kitchen trailers at affordable prices. We understand that starting a food truck or mobile catering business can be expensive, which is why we offer a range of mobile kitchen trailer prices to fit any budget.

If you’re in the market for a mobile kitchen trailer for sale, look no further than Golden State Trailer. Our selection of mobile kitchen trailers for sale is second to none, and we offer a variety of options to fit your specific needs.

Our mobile kitchen trailers are designed to be both functional and stylish. We understand that your mobile kitchen is a reflection of your brand, which is why we offer a range of customization options to make your mobile trailer kitchen truly unique.

So why wait? Transform your culinary dreams into a mobile reality today with a mobile kitchen trailer from Golden State Trailer. Contact us today to learn more about our selection of mobile kitchen trailers for sale!

- Ice Cream, Snowcone & Snowball Trucks

Find Your Dream Ice Cream Truck for Sale Today

Are you looking for the perfect ice cream truck to start your own business? Look no further than Golden State Trailer! Our company specializes in creating high-quality food trucks and trailers, including a wide selection of ice cream trucks for sale.Our ice cream trucks are designed with both functionality and style in mind. With a range of sizes and features available, you can find the perfect truck to fit your needs and your budget. Plus, all of our trucks are built with top-of-the-line materials and equipment to ensure they last for years to come.

Whether you’re just starting out in the ice cream business or you’re looking to expand your existing fleet, Golden State Trailer has the perfect sale ice cream truck for you. We offer a variety of options to choose from, including both new and used trucks, so you can find the perfect fit for your needs and your budget.

And with our convenient location, finding an ice cream truck for sale near me has never been easier. We’re always here to help you find the perfect truck for your business, and our team of experts is always on hand to answer any questions you may have.

So don’t wait any longer to start your own ice cream truck business. Contact Golden State Trailer today to learn more about our ice cream truck sales and find the perfect truck for your needs!

Coolest Ice Cream Trucks for Sale – Customized to Your Needs

Are you looking for the coolest ice cream trucks for sale? Look no further than Golden State Trailer! Our company specializes in creating customized food trucks and trailers, including ice cream trucks that are perfect for any business or event.Whether you’re just starting out in the ice cream business or you’re looking to upgrade your current vehicle, we have the perfect ice cream truck for sale. Our trucks are built to last and are designed with your needs in mind. We can customize your truck with all the features you need to make your business a success, from freezers and storage space to serving counters and signage.

Our ice cream trucks for sale come in a variety of sizes and styles, so you can choose the one that best fits your needs. We have everything from small, compact trucks for street vending to larger, more elaborate trucks for special events and festivals.

At Golden State Trailer, we understand that every business is unique, which is why we offer customized solutions to meet your specific needs. Our team of experts will work with you to design and build the perfect ice cream truck for your business, ensuring that it meets all of your requirements and exceeds your expectations.

If you’re looking for an ice cream truck for sale near me, look no further than Golden State Trailer. Our trucks are top-quality and built to last, ensuring that your business will thrive for years to come. Don’t miss out on this opportunity to own a customized ice cream truck that will set you apart from the competition.

So why wait? Contact us today to learn more about our ice cream truck sales and to get started on building the perfect truck for your business. We can’t wait to help you achieve your dreams!

Cool Down with our Premium Ice Cream Trucks for Sale

Looking for a way to beat the heat and cool down this summer? Look no further than Golden State Trailer’s premium ice cream trucks for sale! Our high-quality, customizable trucks are the perfect mobile solution for any ice cream vendor or business owner looking to expand their offerings.Our ice cream trucks for sale are built to last, with durable materials and top-of-the-line equipment. Whether you’re looking for a classic ice cream truck design or something more modern and unique, our team can help you create the perfect vehicle to suit your needs.

At Golden State Trailer, we understand that quality is key when it comes to serving up delicious frozen treats. That’s why our ice cream trucks are equipped with everything you need to make and serve the best ice cream around. From top-of-the-line ice cream machines to built-in freezers and refrigerators, our trucks are designed to help you deliver a top-notch product every time.

When you purchase an ice cream truck from Golden State Trailer, you’re not just getting a vehicle – you’re getting a partner. Our team of experts is here to help you every step of the way, from designing and building your truck to providing ongoing support and maintenance. We’re committed to helping you succeed and grow your business, and we’ll do whatever it takes to make that happen.

So if you’re looking for a way to stand out from the competition and grow your ice cream business, look no further than Golden State Trailer’s ice cream trucks for sale. With our high-quality vehicles and unparalleled support, you’ll be on your way to sweet success in no time!

- Taco Food Trailers & Trucks

Taco Trailers for Sale: Find Your Perfect Taco Food Trailer

Are you looking for the perfect taco food trailer? Look no further than Golden State Trailer! Our company specializes in creating top-of-the-line taco trailers for sale.Our taco trailers are designed with your needs in mind. Whether you’re a seasoned taco truck owner or just starting out, we have the perfect taco trailer for sale to fit your needs.

Our taco trailers are customizable and come with everything you need to get started. From state-of-the-art kitchen equipment to ample storage space, our trailers are the perfect solution for any taco food trailer owner.

Don’t settle for just any taco trailer for sale. Choose Golden State Trailer for the highest quality trailers on the market. Our trailers are built to last and are sure to impress your customers.

At Golden State Trailer, we understand that your taco trailer is more than just a business. It’s a passion. That’s why we put our heart and soul into every trailer we build. We want to help you succeed in your taco business and make your dreams a reality.

So why wait? Check out our selection of taco trailers for sale today and find the perfect trailer for your business. Whether you’re looking for a trailers for tacos or a tacos trailer, we have everything you need to get started.

Choose Golden State Trailer and start your journey to taco truck success today!

Hit the Road: Get Your Tacos Trailer Today!

Are you looking for a way to take your taco business on the road? Look no further than Golden State Trailer! Our expertly crafted taco trailers and food trucks are the perfect solution for entrepreneurs who want to hit the road and bring delicious tacos to the masses.Our selection of taco trailers for sale is second to none. We offer a variety of sizes and styles to fit your unique needs and budget. Whether you’re just starting out or looking to expand your business, we have the perfect trailer for you.

Our trailers for tacos are built to last, with high-quality materials and expert craftsmanship. We understand that your business is important to you, which is why we go above and beyond to ensure that your trailer is reliable, durable, and easy to use.

So why wait? Hit the road and start serving up delicious tacos today with a Golden State Trailer! Our expert team is here to help you every step of the way, from selecting the perfect trailer to customizing it to your unique specifications. With our help, you’ll be on your way to taco success in no time.

Don’t miss out on this opportunity to take your business to the next level. Contact us today to learn more about our taco food trailers for sale and how we can help you hit the road and make your taco dreams a reality!

Drive Your Catering Dreams with Tacos Trailers for Sale

Are you dreaming of starting your own catering business but don’t know where to start? Look no further than Golden State Trailer and our selection of taco trailers for sale!Our high-quality trailers are designed specifically for the food industry and are perfect for creating a mobile kitchen that can take your tacos to the streets. With a range of sizes and customization options available, you’re sure to find the perfect trailer to fit your needs.

Whether you’re starting a new business or expanding your existing one, our taco trailers for sale are the perfect choice. With their sleek design and durable construction, they’re built to last and will help you stand out from the competition.

At Golden State Trailer, we understand that every business is unique, which is why we offer a range of customization options to ensure that your taco trailer is tailored to your specific needs. From custom paint jobs to specialized equipment, we can help you create the perfect mobile kitchen for your business.

So why wait? Find your perfect taco trailer for sale today and start driving your catering dreams with Golden State Trailer. With our top-of-the-line trailers and expert customer service, you’ll be on your way to success in no time.

Don’t settle for anything less than the best. Choose Golden State Trailer and our tacos trailers for sale to take your business to the next level.

One of the main reasons that Taco Food Trailers are so profitable is the enduring popularity of tacos. Tacos have become a staple food in the United States and are a universally loved treat that never goes out of style. They can appeal to a wide range of customers, from families to college students, and everyone in between.

Another benefit of opening a Taco Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Taco Food Trailer, you can take your business to different locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose where you want to set up, whether it be in a busy downtown area or at a local event.

Another benefit of owning a Taco food trailer is the ability to experiment with different flavors and ingredients. Entrepreneurs can get creative and offer a variety of Taco options, such as gluten-free, vegan, or different types of meats, sauces, and salsas. This can set your Taco food trailer apart from the competition and attract customers with a wide range of taste preferences.

Finally, Food trailers are a great way to create a unique branding and marketing strategy, as it is a moving billboard for your business. And with the help of social media, you can easily reach a large audience, and attract customers to your food trailer.

- BBQ Trailers & Trucks For Sale

Find Your Perfect BBQ Trailer: Concession, Food, Grill, and Smoker Trailers for Sale

Looking for the perfect BBQ trailer to take your food business to the next level? Look no further than Golden State Trailer! Our selection of concession, food, grill, and smoker trailers for sale has everything you need to serve up mouth-watering BBQ wherever you go.Whether you’re looking for a BBQ concession trailer for sale or a custom BBQ trailer, we have options to suit every need and budget. Our trailers are built to last, with high-quality materials and expert craftsmanship that ensures they can handle even the busiest events.

Our BBQ food trailers for sale are perfect for those who want to take their food on the road. Whether you’re catering a wedding, serving up lunch at a festival, or bringing your food to the masses at a food truck rally, our BBQ food truck trailer is the perfect way to do it.

If you’re looking for BBQ grill trailers for sale, we have a wide variety of options to choose from. From small, portable grills to large, commercial-grade smokers, our selection has everything you need to cook up the perfect BBQ.

At Golden State Trailer, we pride ourselves on providing our customers with the highest quality BBQ trailers for sale. Our trailers are built to last, with durable materials and expert craftsmanship that ensures they can handle even the toughest conditions.

So if you’re looking for BBQ trailers for sale near me, look no further than Golden State Trailer. With our wide selection of trailers and unbeatable prices, we’re the go-to choice for anyone looking to take their food business to the next level.

Ready to find your perfect trailer? Browse our selection of BBQ trailers for sale today and find the perfect option for your needs!

Revolutionize Your Food Business with our High-Quality BBQ Trailers

Are you looking for a way to revolutionize your food business? Well, look no further than Golden State Trailer! Our high-quality BBQ trailers are the perfect solution for any food business looking to take things to the next level.Our BBQ concession trailers for sale are the perfect way to bring your delicious food to the masses. With a variety of sizes and styles to choose from, you’re sure to find the perfect fit for your business.

Our BBQ food trailers are built to last, with top-of-the-line materials and expert craftsmanship. And with our BBQ food trailers for sale near me, you can get your hands on one of these amazing trailers in no time.

Looking for something a little different? Check out our custom BBQ trailers for sale. We can work with you to create a trailer that perfectly fits your business’s needs and style.

Our BBQ grill trailers for sale are also a great option for any business looking to expand their offerings. And with our BBQ smoker trailer for sale near me, you can take your smoked meats to the next level.

So what are you waiting for? Check out our BBQ trailer for sale and revolutionize your food business today!

Upgrade Your Business with Custom BBQ Trailers for Sale

Upgrade your business with a custom BBQ trailer for sale from Golden State Trailer! We specialize in designing and manufacturing top-quality food trailers and food trucks, perfect for all your culinary needs.Whether you’re looking for a BBQ food trailer for sale, a BBQ food truck trailer, or a custom BBQ trailer, we’ve got you covered. Our trailers are built to last, with durable materials and expert craftsmanship that ensures you get the best value for your investment.

Our BBQ trailers are perfect for catering events, food festivals, and even for setting up your own food business. With our concession BBQ trailers for sale, you can take your culinary creations anywhere you go, and serve up delicious BBQ food to your customers.

Looking for BBQ food trailers for sale near me? Look no further than Golden State Trailer! We offer a wide range of trailers to choose from, including BBQ grill trailers for sale, BBQ smoker trailers for sale near me, and even trailer BBQs for sale.

With our custom BBQ trailers for sale, you can customize your trailer to suit your specific needs and preferences. From the size and layout to the equipment and accessories, we’ll work with you every step of the way to create the perfect trailer for your business.

Upgrade your business today with a custom BBQ trailer for sale from Golden State Trailer. Contact us today to learn more about our BBQ trailers and find the perfect one for your business.

Don’t wait! Our concession BBQ trailers for sale near me are going fast, so be sure to get in touch with us today to secure your trailer and take your business to the next level.

One of the main reasons that Barbecue BBQ Food Trailers are so profitable is the enduring popularity of barbecue. Barbecue is a classic and timeless dish that is enjoyed by people of all ages and backgrounds. It’s a comfort food that is perfect for any occasion, from casual events to more formal gatherings, making it a great option for a wide range of customers.

Another benefit of opening a Barbecue BBQ Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Barbecue BBQ Food Trailer, you can take your business to different locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose where you want to set up, whether it be in a busy downtown area or at a local event.

Another benefit of owning a Barbecue BBQ food trailer is the ability to experiment with different flavors and ingredients. Entrepreneurs can get creative and offer a variety of barbecue options, such as different types of meats, sauces, and rubs. This can set your Barbecue BBQ food trailer apart from the competition and attract customers with a wide range of taste preferences.

- Pizza Food Trailers & Trucks

Pizza Trailers for Sale: Find Your Perfect Pizza Concession Trailer

Are you looking for a new business venture? Do you have a passion for pizza? Look no further than Golden State Trailer’s pizza trailers for sale!Our pizza concession trailers are the perfect way to take your love of pizza on the road. Whether you’re starting a new food trailer business or looking to expand your current pizza operation, our pizza trailers are the perfect solution.

Our pizza trailers come equipped with everything you need to make delicious, authentic pizza on the go. Each trailer features a pizza oven on a trailer, so you can cook up fresh, hot pies wherever you go. And with our pizza trailers for sale, you can find the perfect size and layout to fit your needs.

At Golden State Trailer, we understand that every pizza business is unique. That’s why we offer a range of pizza concession trailers for sale, so you can find the perfect fit for your business. Whether you need a small trailer for a local farmers market or a larger trailer for a busy event, we have you covered.

Our pizza food trailers for sale are built to last, with high-quality materials and expert craftsmanship. And with our pizza oven trailers for sale, you can be sure that your pizza will be cooked to perfection every time.

So why wait? Start your pizza mobile business today with Golden State Trailer’s pizza trailers for sale. With our trailer of pizza, you’ll be the talk of the town and the go-to spot for delicious, authentic pizza.

Get Rolling with the Best: High-Quality Pizza Trailers for Sale

Get ready to take your pizza-making skills to the next level with Golden State Trailer’s high-quality pizza trailers for sale. Our mobile pizza trailers are the perfect solution for those who want to bring their delicious pies to the masses.With our pizza concession trailers for sale, you can take your business on the road and serve up fresh, hot slices wherever you go. Our pizza food trailers for sale are designed with the needs of pizza chefs in mind, featuring ample space for prep and cooking, as well as storage for ingredients and supplies.

One of the standout features of our pizza trailers is the pizza oven on trailer. This innovative design allows you to cook pizzas on the go, without having to worry about finding a stationary oven. And with our pizza oven trailer for sale, you can own your very own mobile pizza oven and take your business to the next level.

Our pizza oven trailers are built to last, with high-quality materials and expert craftsmanship. And with a trailer of pizza from Golden State Trailer, you can be sure that your customers will be coming back for more.

So why wait? Get rolling with the best and invest in one of our pizza trailers for sale. Whether you’re just starting out or looking to expand your business, our pizza concession trailers for sale are the perfect choice for any pizza lover.

Don’t miss out on this opportunity to own a pizza food trailer for sale from Golden State Trailer. Contact us today to learn more about our pizza trailers and how they can help take your business to the next level.

Upgrade Your Mobile Pizzeria Game with our State-of-the-Art Trailers

Are you ready to take your mobile pizzeria game to the next level? Look no further than Golden State Trailer, the leading manufacturer of state-of-the-art pizza concession trailers.Our trailers are designed to help you create the perfect pizza every time. With a pizza oven on the trailer, you can cook up delicious pies on-the-go and serve them fresh to your hungry customers.

Our pizza concession trailers are available for sale now, so you can upgrade your business and start making more dough. Whether you’re looking for a pizza food trailer for sale or a pizza oven trailer, we have the perfect solution for you.

At Golden State Trailer, we understand that your business needs a reliable and efficient trailer of pizza to keep up with demand. That’s why we use only the highest quality materials and expert craftsmanship to build our pizza trailers.

With a mobile pizza concession trailer from Golden State Trailer, you’ll be the talk of the town. Our trailers are not only functional, but they’re also stylish and eye-catching. You’ll attract customers from far and wide with your new pizza trailer.

Upgrade your mobile pizzeria game today with one of our pizza trailers for sale. Contact us now to learn more about our pizza oven trailers and pizza concession trailers.

One of the main reasons that Pizza Food Trailers are so profitable is the enduring popularity of pizza. Pizza is a classic dish that is enjoyed by people of all ages and backgrounds. It’s an easy meal to prepare and it can be served in many different ways, which makes it appealing to a wide range of customers.

Another benefit of opening a Pizza Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Pizza Food Trailer, you can take your business to different locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose where you want to set up, whether it be in a busy downtown area or at a local event.

Another benefit of owning a Pizza food trailer is the ability to experiment with different flavors and ingredients. Entrepreneurs can get creative and offer a variety of Pizza options, such as gluten-free, vegan, or different types of sauces, meats, and vegetables. This can set your Pizza food trailer apart from the competition and attract customers with a wide range of taste preferences.

Finally, Food trailers are a great way to create a unique branding and marketing strategy, as it is a moving billboard for your business. And with the help of social media, you can easily reach a large audience, and attract customers to your food trailer.

- Hot Dog Trucks & Trailers for Sale

Find Your Perfect Hot Dog Trailer: Concession Trailers for Sale

Looking for the perfect hot dog trailer? Look no further than Golden State Trailer! Our company specializes in producing top-of-the-line food trailers and carts, including hot dog concession trailers for sale.Our hot dog concession trailers are perfect for anyone looking to start a mobile food business. With a variety of sizes and styles to choose from, we have the perfect hot dog food trailer for sale to fit your needs.

Whether you’re looking for a hot dog cart trailer for a small business or a larger trailer for a more established operation, we have you covered. Our hot dog trailer carts for sale are built to last, with durable materials and expert craftsmanship.

At Golden State Trailer, we’re dedicated to providing our customers with the best possible products and service. That’s why we offer a wide range of hot dog concession trailers for sale, each designed to meet the unique needs of our customers.

So if you’re looking for a mobile hot dog trailer, look no further than Golden State Trailer. With our high-quality trailers, expert craftsmanship, and unbeatable customer service, we’re the perfect choice for anyone looking to start a successful food business.

Hit the Road with Delicious Flavors: Hot Dog Trailers for Sale

Hit the road with delicious flavors and make your food business mobile with Golden State Trailer’s hot dog concession trailers for sale! Our top-of-the-line trailers are perfect for serving up mouth-watering hot dogs on the go.Our hot dog concession trailers are designed to meet all your needs, whether you’re just starting out or looking to expand your existing business. We offer a variety of sizes and styles, including hot dog food trailers, hot dog trailer carts for sale, and even mobile hot dog trailers.

Our hot dog concession trailers for sale are built with quality and durability in mind, ensuring that your investment will last for years to come. You’ll be able to hit the road with confidence, knowing that your trailer is up to the task of serving up delicious hot dogs to hungry customers.

With a Golden State Trailer hot dog food trailer for sale, you’ll be able to take your business anywhere. Whether you’re setting up at a local fair or festival, or just cruising around town, our trailers are sure to draw a crowd.

So why wait? Get your hot dog trailer for sale today and start serving up the best hot dogs in town! Contact Golden State Trailer to learn more about our hot dog concession trailers and how they can help you take your business to the next level.

Rev up your food game with our Hot Dog Trailers for Sale

Are you ready to take your food game to the next level? Look no further than Golden State Trailer’s hot dog concession trailers for sale. Our top-of-the-line hot dog food trailers are the perfect addition to any concession business.With our mobile hot dog trailer options, you can take your delicious menu on the road and reach even more hungry customers. Our hot dog trailer carts for sale are customizable to fit your specific needs and style, so you can stand out from the competition.

At Golden State Trailer, we believe that quality should never come at a high cost. That’s why we offer hot dog food trailers for sale at affordable prices. Don’t miss out on the opportunity to rev up your food game and increase your profits with our hot dog trailer for sale.

Whether you’re just starting out or looking to expand, our hot dog trailers are the perfect addition to any concession business. So why wait? Contact Golden State Trailer today and get started on your journey to success with our hot dog trailer for concession business.

One of the main reasons that Hot Dog Food Trailers are so profitable is the enduring popularity of hot dogs. Hot dogs have been a staple food for decades and are a universally loved treat that never goes out of style. They can appeal to a wide range of customers, from families to college students, and everyone in between.

Another benefit of opening a Hot Dog Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Hot Dog Food Trailer, you can take your business to different locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose where you want to set up, whether it be in a busy downtown area or at a local event.

Another benefit of owning a Hot Dog food trailer is the ability to experiment with different flavors and ingredients. Entrepreneurs can get creative and offer a variety of Hot Dog options, such as gluten-free, vegan, or different types of toppings. This can set your Hot Dog food trailer apart from the competition and attract customers with a wide range of taste preferences.

- Gyro Food Trailers & Trucks

If you’re looking to start your own food business or expand your current one, a gyro food trailer can be a great investment. Not only are gyro food trailers versatile and affordable, but they also offer an easy way to take your delicious dishes to a wider audience. One of the best options for gyro food trailers on the market is Golden State Trailer. In this article, we’ll take a comprehensive look at what Golden State Trailer has to offer and why it’s a great choice for gyro food trailers.

Why Choose Golden State Trailer

Golden State Trailer has been in business for over 35 years, providing high-quality food trailers and trucks to entrepreneurs across the country. The company is known for its exceptional customer service and attention to detail, which has helped it build a strong reputation in the industry. When you choose Golden State Trailer for your gyro food trailer needs, you can be sure that you’re getting a reliable and well-made product that will help you achieve your business goals.

Types of Gyro Food Trailers Available

Golden State Trailer offers a range of gyro food trailers to suit different needs and budgets. Whether you’re just starting out or looking to expand your existing business, you can find a trailer that fits your requirements. Some of the popular gyro food trailers available at Golden State Trailer include:6′ x 10′ Gyro Trailer

8.5′ x 20′ Gyro Trailer

8.5′ x 28′ Gyro Trailer

Customized Gyro TrailersCustomization Options

One of the best things about Golden State Trailer is that it offers a wide range of customization options for its gyro food trailers. You can choose from a variety of colors, sizes, and layouts to create a trailer that suits your specific needs. You can also add features such as refrigerators, freezers, sinks, and grills to make your trailer more functional and efficient.

Materials and Quality

Golden State Trailer uses high-quality materials and state-of-the-art equipment to manufacture its gyro food trailers. The trailers are made of sturdy steel frames and aluminum exteriors, which are both durable and lightweight. The trailers also come equipped with high-quality appliances and equipment, ensuring that you can serve your customers delicious food without any hassles.

Pricing

Pricing for gyro food trailers at Golden State Trailer varies depending on the size and customization options you choose. However, the company is known for offering affordable pricing that is competitive with other manufacturers in the industry. You can request a quote from Golden State Trailer to get a better idea of how much your desired gyro food trailer will cost.

Delivery and Warranty

Golden State Trailer offers delivery services to all 50 states in the USA. The company also provides a warranty on all its gyro food trailers, ensuring that you’re protected against any manufacturing defects or issues that may arise.

Financing Options

If you’re unable to pay for your gyro food trailer upfront, Golden State Trailer offers financing options to make your purchase more affordable. You can work with the company’s financing partners to get the best possible rates and terms.

Customer Reviews

Golden State Trailer has received many positive reviews from satisfied customers across the country. Customers praise the company’s excellent customer service, high-quality products, and reasonable pricing.One of the main reasons that Gyro Food Trailers are so profitable is the growing demand for diverse and authentic international cuisine. In recent years, the popularity of Gyro has risen dramatically in the United States, as more and more people are looking to try new and exciting flavors. With a Gyro Food Trailer, you can bring these flavors directly to your customers, whether they are at a food festival, farmers market, or other event.

Another benefit of opening a Gyro Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Gyro Food Trailer, you can take your business to different locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose where you want to set up, whether it be in a busy downtown area or at a local event.

Another benefit of owning a Gyro food trailer is the ability to experiment with different flavors and ingredients. Entrepreneurs can get creative and offer a variety of Gyro options, such as gluten-free, vegan, or different types of meats. This can set your Gyro food trailer apart from the competition and attract customers with a wide range of taste preferences.

Finally, Food trailers are a great way to create a unique branding and marketing strategy, as it is a moving billboard for your business. And with the help of social media, you can easily reach a large audience, and attract customers to your food trailer.

- View all

- Mobile Kitchen Trailer

- Additional info

- Shop

- Projects

- Financing

- About Us

- Contact Us

- More

- Shop

- Best Sellers

The Best Seller food trailer for sale industry has been booming in recent years. Entrepreneurs everywhere are taking advantage of this lucrative business opportunity, and for a good reason! Food trailers provide flexibility, affordability, and the chance to share your culinary passion with the world. One of the most popular and reliable food trailer manufacturers is Golden State Trailer. In this article, we’ll cover the best sellers food trailers for sale by Golden State Trailer and discuss their unique features, customization options, and benefits.

- Specials

- Food Trailers Sizes

- Food Trailers Types

- Concession Food Trailers & Trucks

Concession food trailers are a great way to start your own food business. These trailers are mobile, affordable, and versatile. You can take your food business anywhere, and they offer a low entry point for entrepreneurs. In this article, we will discuss concession food trailers for sale at Golden State Trailer, one of the leading trailer manufacturers in the USA.

Introduction

Concession food trailers are a popular choice for those who want to start their own food business. They are ideal for food trucks, food stands, and catering services. With a concession trailer, you can take your business to different locations, attend events and fairs, and serve your food to a wider audience. Golden State Trailer offers a variety of concession food trailers that are affordable, customizable, and built to last.

Advantages of Concession Food Trailers

Before we dive into the specifics of Golden State Trailer’s concession food trailers, let’s explore the advantages of these trailers:

Mobility

One of the biggest advantages of concession food trailers is their mobility. You can take your business to different locations and serve a wider audience. You can attend events, fairs, and festivals, and cater to different crowds.

Affordability

Concession food trailers offer a low entry point for entrepreneurs who want to start their own food business. They are cheaper than brick-and-mortar restaurants, and you can customize them to suit your needs and budget.

Customizability

Concession food trailers are highly customizable. You can design your trailer to fit your business needs and brand. You can choose the size, layout, equipment, and decorations that fit your style and cuisine.

Versatility

Concession food trailers can be used for a variety of food businesses, such as food trucks, food stands, and catering services. They are versatile and can be adapted to different cuisines and cooking styles.

Golden State Trailer’s Concession Food Trailers

Golden State Trailer is a leading manufacturer of concession food trailers in the USA. They offer a variety of trailers that are customizable, affordable, and built to last. Here are some of the trailers they offer:

Food Truck Trailers

Golden State Trailer offers a range of food truck trailers that are designed for mobility and versatility. They are ideal for food truck businesses, and you can customize them to fit your needs and budget.

Concession Trailers

Concession trailers are designed for food stands and catering services. They are affordable and customizable, and you can choose the size, layout, and equipment that fit your business needs.

BBQ Trailers

BBQ trailers are designed for BBQ businesses and outdoor cooking. They are customizable, and you can choose the size, layout, and equipment that fit your cooking style.

Catering Trailers

Catering trailers are designed for catering services and events. They are customizable, and you can choose the size, layout, and equipment that fit your catering needs.

Mobile Kitchens

Mobile kitchens are designed for professional chefs and cooking services. They are customizable, and you can choose the size, layout, and equipment that fit your cooking style.

Why Choose Golden State Trailer?

Golden State Trailer offers a range of concession food trailers that are affordable, customizable, and built to last. Here are some reasons to choose them:

Quality

Golden State Trailer uses high-quality materials and equipment to build their trailers. They are designed to withstand the wear and tear of mobile cooking and last for years.

Customizability

Golden State Trailer offers a range of customization options, so you can design your trailer to fit your business needs and brand.

Customer Service

Golden State Trailer offers excellent customer service and support. They can help you with the design, construction, and maintenance of your trailer.One of the main reasons that Concession Food Trailers are so profitable is the high demand for food at events. People attend events to have a good time and often look for a variety of food options to enjoy while they are there. With a Concession Food Trailer, you can provide a wide range of food options, such as burgers, hot dogs, popcorn, cotton candy, and more, meeting the diverse needs of your customers.

Another benefit of opening a Concession Food Trailer is the relatively low cost of entry compared to a traditional brick and mortar restaurant. Food trailers can be purchased or leased for a fraction of the cost of a restaurant, and they do not require the same level of investment in equipment, furniture, and fixtures. This makes it much easier for entrepreneurs to get started and test the waters before making a larger investment.

Additionally, food trailers offer a lot of flexibility and mobility. With a Concession Food Trailer, you can take your business to different events and locations, which allows you to reach new customers and expand your customer base. You also have the freedom to choose which events to attend, whether it be a local fair or a major sporting event.

Another benefit of owning a Concession Food Trailer is the ability to experiment with different food options and to adapt to the event or location. Entrepreneurs can get creative and offer a variety of food options that suit the event, such as a variety of popcorn flavors at a movie night, or offer healthier options such as fresh fruits or salads.

Finally, Food trailers are a great way to create a unique branding and marketing strategy, as it is a moving billboard for your business. And with the help of social media, you can easily reach a large audience, and attract customers to your food trailer.

- Custom Food Trailers

About Golden State Trailers

Golden State Trailers is a leading manufacturer of custom food trailers. We pride ourselves on providing our customers with top-quality products that meet their specific needs. We have a team of experienced professionals who work tirelessly to ensure that each trailer we build is of the highest quality.

Our Products

We offer a wide range of custom food trailers for sale. Whether you’re looking for a small trailer to sell hot dogs or a large trailer to serve a full menu, we have options that will meet your needs. All of our trailers are built with high-quality materials and are designed to be durable and long-lasting.Some of our most popular trailers include:

Concession Trailers – Perfect for selling snacks, beverages, and other small items.

BBQ Trailers – Ideal for serving up delicious barbecue dishes.

Pizza Trailers – A great option for pizza lovers.

Ice Cream Trailers – Perfect for selling ice cream and other frozen treats.

Food Trucks – Ideal for serving a full menu of food.In addition to these options, we also offer custom trailers designed to meet your specific needs. Whether you need a trailer with a specific layout, additional equipment, or unique branding, we can help.

Why Choose Golden State Trailers?

When you choose Golden State Trailers, you’re choosing a company that is committed to your success. We work with you every step of the way to ensure that your trailer meets your specific needs. From the initial design phase to the final delivery, we’re here to help.Our trailers are built to last and are designed with your business in mind. We use only the highest quality materials and equipment, ensuring that your trailer will be durable and reliable.

Contact Us Today

If you’re ready to explore our catalog of custom food trailers for sale, contact Golden State Trailers today. Our team of experts is ready to help you find the perfect trailer for your business. With our help, you’ll be on your way to success in no time.

- Best Sellers

- About Us

- Resources

- Additional info

- Shop